Decentralized Finance Explained 💸

Making DeFi understandable for the common user.

Hey everyone!👋 In this blog post, we are going to learn about DeFi (decentralized finance) and how it works. We will also be looking into some key points which are important for this topic and discuss them too.

DeFi 💰

DeFi or decentralized finance is a movement that aims at making a new financial system that is open to everyone and doesn't require trusting intermediaries like banks. To achieve that DeFi relies heavily on cryptography, blockchain, and smart contracts.

In simple words, DeFi takes products and services from traditional finance and decentralizes them by replacing middlemen with smart contracts.

Today, the most common uses of DeFi are:

Borrowing money

Supply money to earn interest

However, the key thing here is that this all takes place outside of the traditional banking system. That means no KYC, no need to get approval from anyone, no credit scores, no requirement for a bank account, and no discrimination based on where you live.

The DeFi Ecosystem 🏦

The emerging DeFi ecosystem is already home to a wide range of platforms like DeFi loan comparison sites, automated trading solutions, lending platforms, non-custodial margin trading platforms, and much more.

The Future of DeFi? 🔮

Decentralized Finance has already seen phenomenal growth over the last few years. However, there are over 1.7 billion unbanked people in the World excluded from the traditional financial system who could benefit from DeFi.

Imagine if you are living in a developing country with high inflation. DeFi gives you the opportunity to get out of your local currency and hold USD via stable coins like Dai. Even better, you can then take that Dai and lend it out at 5+% interest on DeFi platforms like Compound Finance. DeFi already offers people the tools to hedge out local currency risk and that’s a pretty big deal in countries like Venezuela.

Although DeFi loans currently need to be over-collateralized, I imagine it will only be a matter of time before under-collateralized loans are available via a form of DeFi borrowing reputation system.

Problems With DeFi? 🤔

It’s hard for the average person to access DeFi and that's due to friction between the crypto and traditional finance ecosystem. That’s where tech solutions like Nimiq OASIS can come in by providing FIAT smart contracts which enable non-custodial crypto: fiat trades. This solution is set for launch this year in partnership with Ten31 bank and has been developed by the crypto project Nimiq. Adoption of this solution certainly has the potential to make it much easier for people to access the DeFi ecosystem.

Another major issue facing DeFi is smart contract bugs. These could result in DeFi users losing access to a significant amount of funds and it’s even more worrying seeing that bugs are not unheard of in smart contracts.

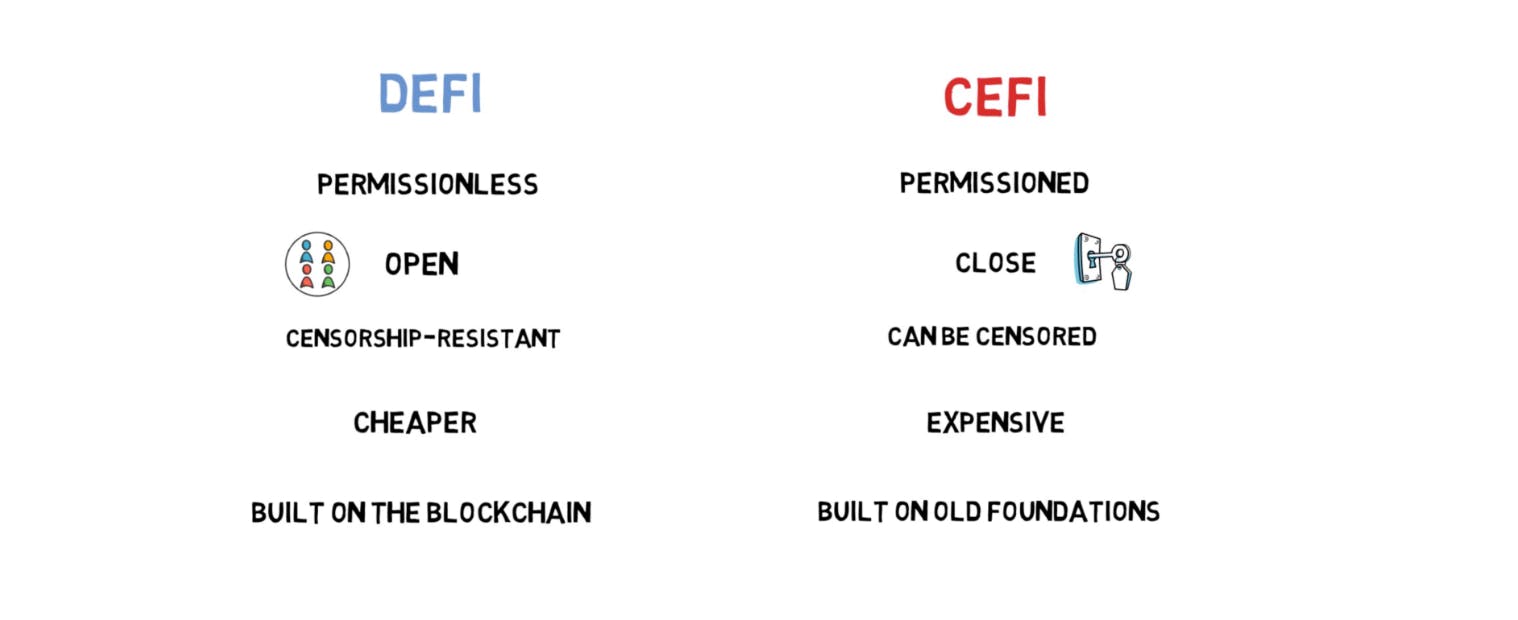

DeFi 🆚 CeFi

Let’s compare the main differences between defi and cefi which stand for centralized or traditional finance.

Summary and the future of DeFi 📖

DeFi is a super interesting and vibrant space that is full of opportunities. But, we have to remember that it is still a very nascent industry, so it's high risk and a high reward game.

Defi is the closest thing that can actually disrupt the traditional financial industry. In opposite to most of the fintech companies defi is built on the new rails instead of relying on the outdated technologies and procedures.

Currently, most financial products can be only created by banks. Defi is open, permissionless, and enables cooperative work in a similar way to the Internet.

That's it for this blog post and in the next articles, we will be covering more complex blockchain topics in a simple way. Till then, you can follow our official channels and use our products on your next big web3 project! 👋